Market Overview

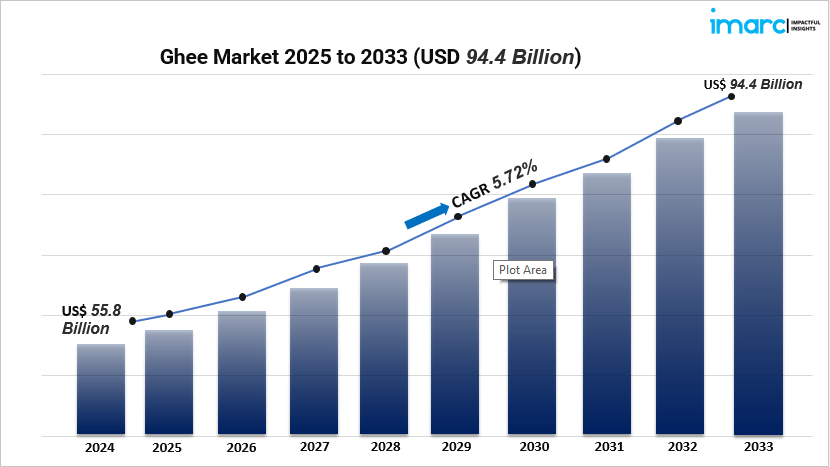

The global ghee market is experiencing robust growth, reaching a valuation of USD 55.8 billion in 2024. Projections indicate a rise to USD 94.4 billion by 2033, with a CAGR of 5.72% during 2025-2033. This expansion is driven by increasing health consciousness, a surge in demand for natural and organic products, and the cultural significance of ghee in various cuisines. The product’s versatility in culinary applications and its perceived health benefits contribute to its growing popularity across diverse consumer segments.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

Ghee Market Key Takeaways

- Market Size & Growth: Valued at USD 55.8 billion in 2024, the global ghee market is projected to reach USD 94.4 billion by 2033, growing at a CAGR of 5.72% during the forecast period.

- Health Consciousness: Rising awareness of ghee’s health benefits, including its rich nutrient profile, is driving consumer preference for traditional cooking fats over processed alternatives.

- Organic & Artisanal Demand: There’s a growing trend towards organic and artisanal ghee, with consumers seeking high-quality, authentic products that align with health-conscious lifestyles.

- E-commerce Expansion: The proliferation of online retail channels is enhancing ghee’s accessibility, allowing brands to reach a broader audience and cater to niche markets.

- Cultural Significance: Ghee’s integral role in traditional cuisines and rituals, especially in regions like India, continues to sustain its demand.

Market Growth Factors

1. Health and Wellness Trends

The growing global focus on health and wellness has had a big impact on what people choose to eat, with many turning to natural and nutrient-packed foods. Ghee, celebrated for its rich supply of vitamins A, D, E, and K, along with healthy fatty acids, fits perfectly into this trend. Its benefits, like supporting digestion and enhancing immunity, make it a go-to option for those who prioritize their health. Plus, ghee’s versatility with various diets, including ketogenic and paleo, has broadened its appeal beyond just traditional consumers.

2. Cultural and Traditional Significance

Ghee has a cherished role in numerous cultures, especially in South Asia, where it’s not just a kitchen essential but also plays a key role in religious ceremonies and traditional healing practices. This deep cultural connection keeps the demand steady, as ghee is a staple in festivals, rituals, and everyday meals. Communities around the world, far from their homeland, also help maintain this demand, looking for authentic products that remind them of their roots. This cultural significance creates a strong market that’s less likely to be swayed by fleeting food trends.

3. Technological Advancements and Product Innovation

The ghee industry has seen remarkable technological progress, improving both production efficiency and product quality. Modern processing methods ensure that ghee remains pure and has a longer shelf life, meeting the high standards of today’s consumers. Additionally, new product innovations, like flavored and fortified ghee, cater to changing tastes and nutritional needs. Eco-friendly and convenient packaging designs also boost consumer interest and accessibility.

Ask Analyst for Customization: https://www.imarcgroup.com/ghee-market/requestsample

Market Segmentation

Breakup by Source:

- Cow: Ghee derived from cow’s milk, known for its distinct flavor and nutritional benefits, is widely consumed and holds a significant market share.

- Buffalo: Buffalo milk ghee, characterized by its higher fat content and richer taste, caters to specific regional preferences and culinary applications.

- Mixed: This category includes ghee produced from a combination of cow and buffalo milk, offering a balanced flavor profile and nutritional content.

Breakup by End User:

- Retail: This segment encompasses individual consumers purchasing ghee for household use, influenced by factors like brand loyalty, packaging, and health benefits.

- Institutional: Includes bulk consumers such as restaurants, hotels, and food processing units that utilize ghee as a key ingredient in various culinary preparations.

Breakup by Distribution Channel:

- Supermarkets/Hypermarkets: Large retail outlets offering a wide range of ghee brands and variants, providing consumers with diverse choices and competitive pricing.

- Convenience Stores: Smaller retail stores catering to immediate or local demand, often stocking popular ghee brands for quick purchase.

- Specialty Stores: Retailers focusing on specific product categories, including organic or artisanal ghee, targeting niche consumer segments seeking premium quality.

- Online: E-commerce platforms offering a vast selection of ghee products, facilitating easy comparison, and home delivery, thus expanding market reach.

- Others: Includes alternative distribution channels such as direct sales, cooperatives, and traditional markets, contributing to the product’s accessibility.

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

India is a powerhouse in the global ghee market, thanks to its rich cultural traditions and dietary habits that make ghee a staple. The country’s extensive dairy industry, along with a growing awareness of health and rising disposable incomes, is driving the demand for both traditional and premium ghee products. Plus, government initiatives that promote traditional foods are giving the market an extra boost.

Recent Developments & News

The ghee market has been buzzing with exciting developments to meet changing consumer tastes. Back in September 2022, VRS Foods launched a new range of flavored ghee products, providing unique taste experiences for those looking for something different. Earlier, in July 2022, Amul made headlines with significant investments to ramp up its ghee manufacturing capacity, addressing the surging demand both at home and abroad. These moves show the industry’s dedication to innovation and expanding capacity to keep up with the growing market needs.

Key Players

- SMC Group – Madhusudan

- Amul

- KMF

- VRS Foods

- Nestle

- RSD Group (Gopaljee)

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=710&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145